In-Depth Analysis|The “Black Swan” and “Gray Rhino” in the International Student Rental Market After the 2026 UK Rental Reform Act Takes Effect

If last year's keyword was “universal rent hikes,” then the defining term for London's rental market in 2026 will be “asset clearing.”

As an asset manager in London's real estate industry, I've observed a stark phenomenon: Regulatory Risk is reshaping the supply-side structure of the rental market. For international students arriving in Fall 2026, failing to grasp this underlying logic could lead to renting a “high-risk asset.”

Today, I'll conduct an in-depth simulation across three dimensions: regulatory shifts, market dynamics, and regional selection.

I. Policy Context: The “Tightening Noose” on Landlords

In 2026, the sword of Damocles hanging over UK landlords finally fell. This manifested in two key ways:

- The End of Section 21 (Unjustified Eviction Notices)

This forms the core of the Renters' Rights Bill. It means landlords can no longer arbitrarily repossess properties.

- Market Reaction: Landlords lose their ability to “cut losses at any time,” making the entry level extremely stringent.

- Impact on International Students: Traditional private landlords will favor renting to local residents with stable employment over highly mobile students. Unless you can provide exceptionally strong financial proof (e.g., 6-12 months' rent paid upfront).

- Countdown to MEES (Minimum Energy Efficiency Standards)

Despite government vacillation on the exact timeline, the EPC C requirement remains firmly established.

- Data: Approximately 40% of Victorian/Edwardian properties in London Zones 1-2 currently hold only D or E ratings.

- Consequences: Retrofitting costs average £15k-£25k. This has prompted many cash-strapped small landlords to exit the market by selling their properties. Consequently, the supply of HMOs (Houses in Multiple Occupation) and older terraced houses is projected to shrink by 15%-20% by early 2026.

II. Supply-Side Reform: Who's Taking Over?

As small landlords exit the market, Institutional Capital and Overseas Investors are filling the void.

This is why I consistently emphasize: In 2026, rental decisions must follow capital flows.

- BTR (Build-to-Rent) Projects: Developed and held by large conglomerates, specifically for rental purposes.

- Buy-to-Let New Builds: Semi-new properties held by high-net-worth individuals (many from East Asia).

Both property types exhibit distinct risk-resistant characteristics:

- Compliance: Delivered meeting EPC B/A standards, eliminating renovation pressures.

- Stability: Held for long-term capital appreciation, with rental income serving as supplementary cash flow—no panic selling during policy fluctuations.

- Scalability: Typically operated under full-management models with standardized maintenance response and administrative processes.

III. The “Alpha Strategy” for London Renting in 2026

Based on the above analysis, if your budget permits (£450+/pw), I recommend adopting a “de-stock, go incremental” property selection strategy.

That is: resolutely abandon existing older properties and fully embrace newly built incremental housing.

Below are three recommended areas combining regulatory safety and commuting efficiency:

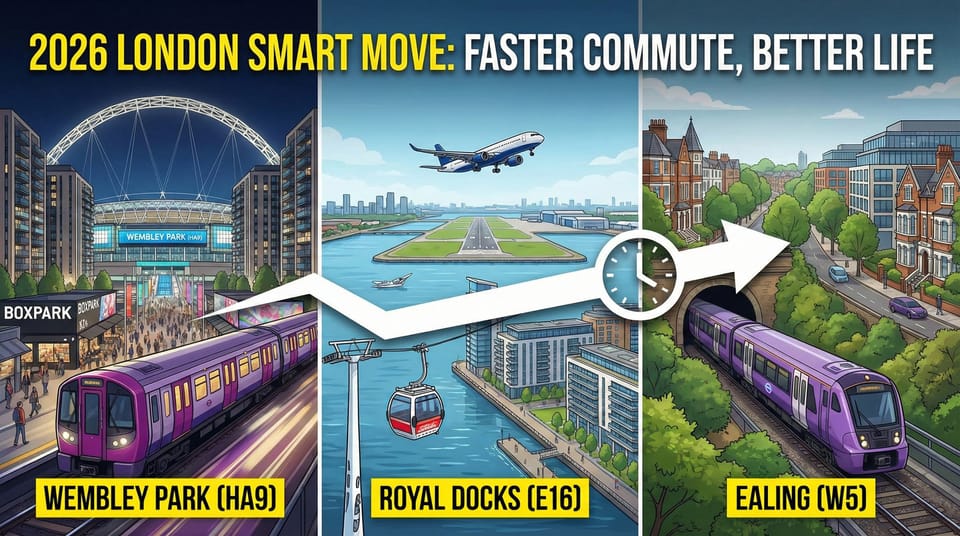

- The “Regulatory Haven”: E14 Canary Wharf & E16 Royal Docks

- Rationale: 90% of buildings here were constructed after 2000.

- Current Status: Following the repeal of Section 21, institutional landlords in this area now actively welcome international students. These tenants offer strong upfront rental payment capacity and fixed lease terms (typically 1 year), aligning perfectly with institutional financial projections.

- Recommended Developments: Landmark Pinnacle, Wardian, Royal Wharf.

- The “Upgraded” West: White City (W12) & Ealing (W5)

- Rationale: Traditional affluent areas in West London (Kensington/Chelsea) are hotspots for EPC non-compliance. White City and Ealing represent two “new-build enclaves” in the west.

- Advantages: Enjoy West London's security and style without enduring old buildings' cold or landlords' hassles.

- The “Planned” City: Wembley Park (HA9)

- Rationale: A uniformly planned district with concentrated BTR (Build-to-Rent) developments.

- Advantages: Rental terms here are exceptionally transparent. No hidden clauses, no mysterious deductions. For international students concerned about legal risks, this is a “special zone governed by the rule of law.”

IV. Summary and Operational Recommendations

In this 2026 policy transition period, renting is not merely finding shelter but a supply chain decision. My advice:

- Check EPC: Verify the target property's Energy Performance Certificate (EPC) on the government website. Firmly avoid any below grade C.

- Ask Ownership Status: Inquire with the agent whether the landlord is an Individual or a Company? Local or Overseas? (Typically, the combination of Overseas Investor + Local Managing Agent offers the most stability).

UKmate manages over 200 premium properties in London that comply with the 2026 regulations.

Our landlord base consists primarily of long-term, stable Chinese high-net-worth buyers. This translates to: more stable tenancies and a more accommodating communication process.

Want to know which areas are least affected by policy changes?

👇 Open WhatsApp to consult a UKmate advisor

WhatsApp: +86 15992727555